The countries of the Visegrad Four (V4) – Czechia, Hungary, Poland, and Slovakia – have had divergent trajectories in their relations with Beijing over the past decade.

In Czechia, the honeymoon period of relations under the leadership of Czech Social Democrats and President Milos Zeman in the mid-2010s gave way to a rift in the relationship, marked by scandals related to China’s interference, unmet economic promises and Czech active engagement in developing ties with Taiwan.

Meanwhile, Hungary has doubled down on the China-friendly course under Prime Minister Viktor Orban, making Hungary the leading recipient of Chinese investment in Europe for the past two consecutive years.

Slovakia, under Prime Minister Robert Fico since 2023, seems to have tried to emulate Orbán’s apparent success in courting Chinese investment by leaning closer to China on political issues, inking a strategic partnership with Beijing last year.

Poland has charted a largely pragmatic course on China, irrespective of the government in power.

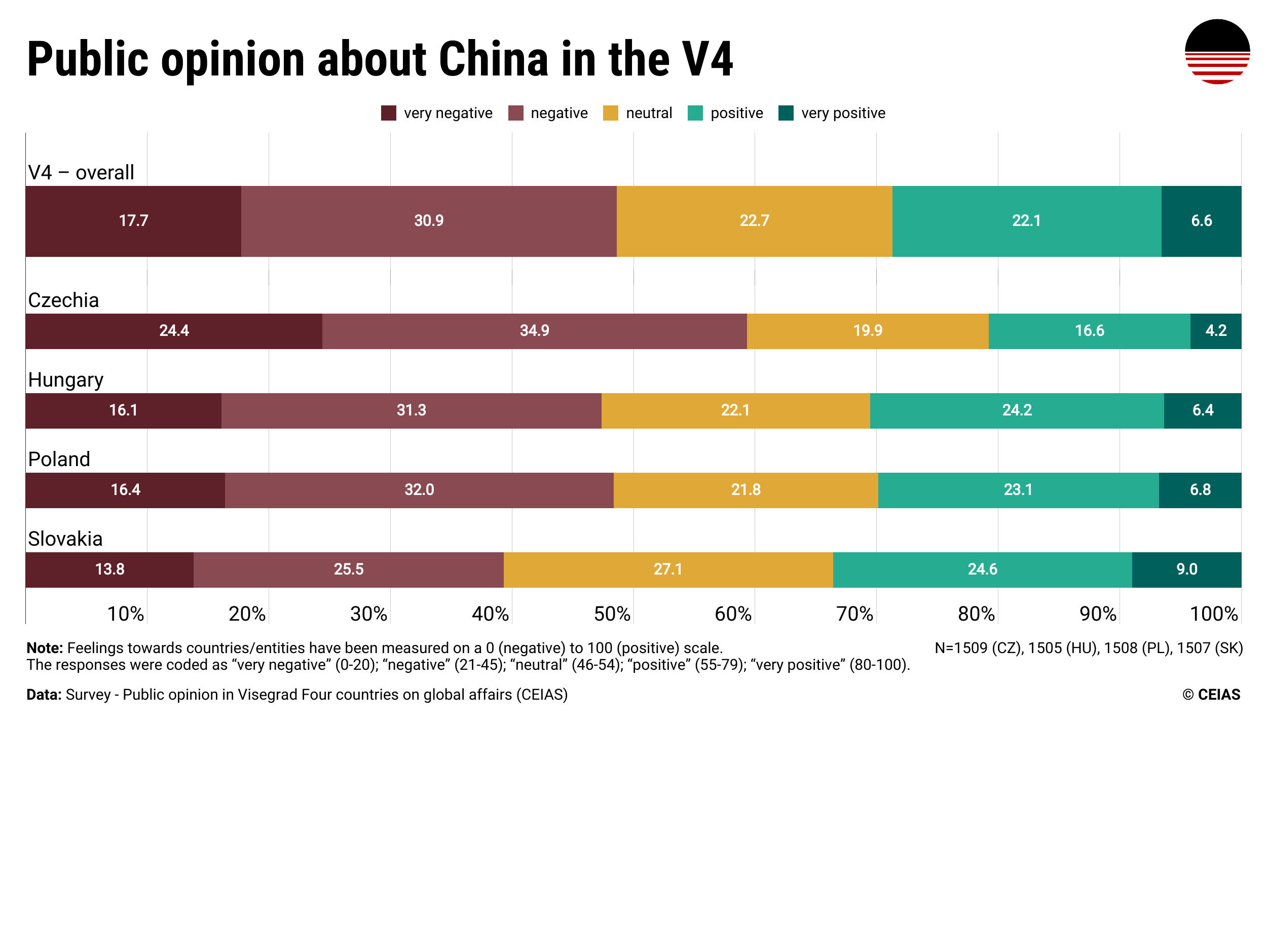

A look into public opinion results, based on the recent large-scale polling by Central European Institute of Asian Studies, provides an interesting complement to government-level dynamics in the respective bilateral relations with Beijing. Overall, Central Europeans remain skeptical of China. The Czechs are the most negative, with 59.3 percent of respondents viewing China unfavorably and only 20.8 percent favorably. Hungarians, despite the cozy relationship of the Orban government with Beijing, are also largely negative toward China, together with the Poles. While Slovaks are overall also negative toward China, they have the highest proportion of positive views of China in the V4, at 33.6 percent, and the lowest share of negative views, at 39.3 percent.

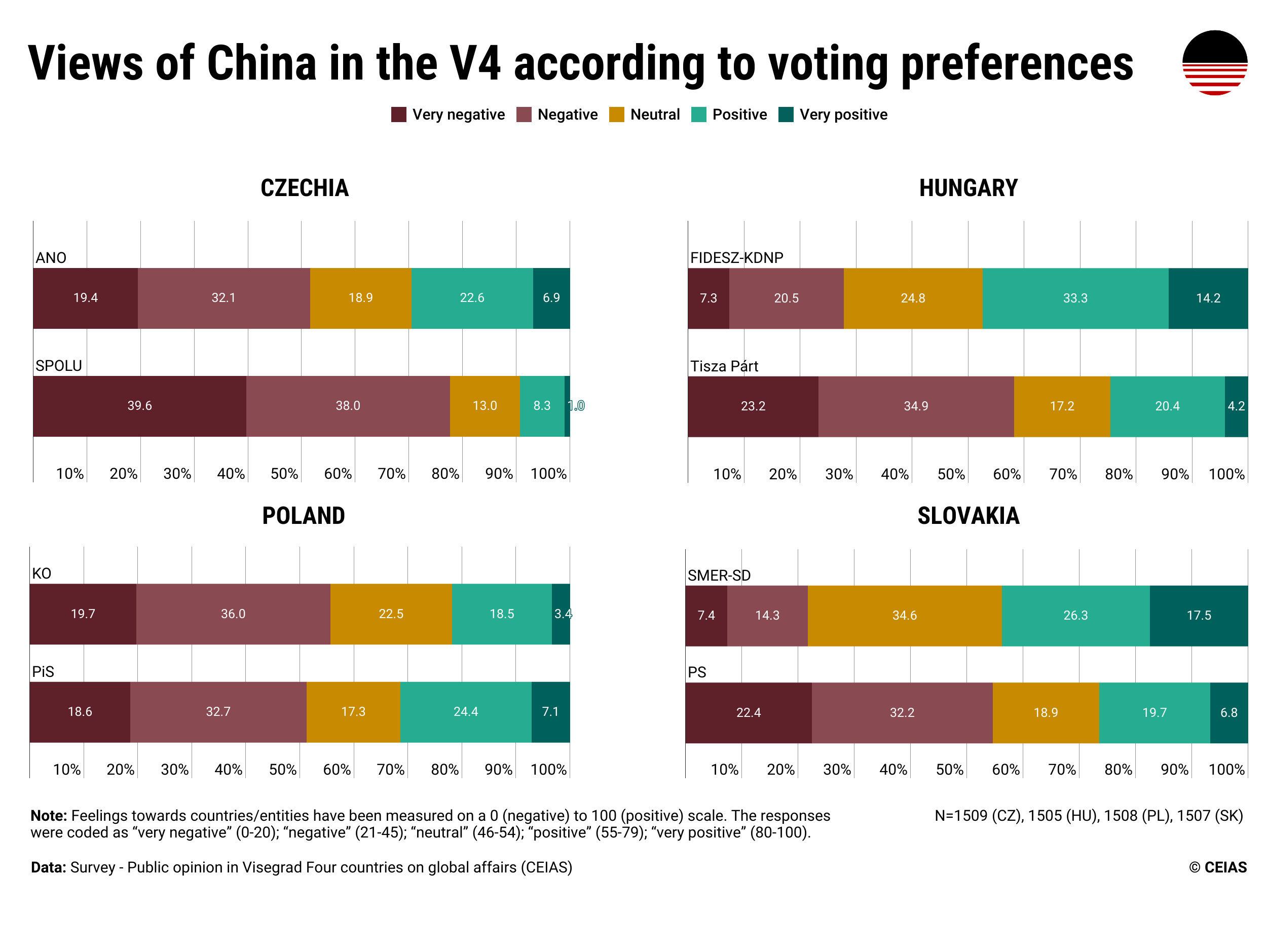

A deeper dive into perceptions of China by political preference provides another layer to the picture. In Hungary, there is a large gulf in perceptions of China between the supporters of the governing Fidesz party and its leading opponent, Tisza. Among supporters of Fidesz, China is viewed positively by 47.5 percent respondents and negatively by 27.8 percent, while for Tisza, it is 24.6 percent and 58.1 percent percent, respectively (the rest expressed neutral views).

Similarly polarized views can be seen in Slovakia, with striking differences in perceptions of China between the supporters of the ruling Smer-SD party and the leading Progressive Slovakia opposition party.

Meanwhile, while China is seen relatively more positively by the voters of ANO in Czechia – as opposed to the voters of the current China-skeptical coalition led by Spolu since 2021 – negative views of China still dominate even among ANO voters.

Finally, in Poland, views of China are comparatively less polarized between KO, the leading party of the current coalition, and PiS, the major opposition party, which is mirrored in the relative continuity of Warsaw’s China policy.

The overall picture shows that conservative voters tend to view China more positively than liberals in Central Europe – an interesting difference when compared to the United States. Meanwhile, negative views of China are more prevalent among the more educated groups of the population. Among the different age groups, the picture is not homogeneous across the V4. While in Czechia and Hungary, the youngest people, aged 18-24, have the most negative view of China, it is the opposite in Slovakia and Poland.

While we cannot assume a direct relationship between the views of the voter base and political parties’ actual policies, the results do offer some hints about what we could expect should the governments change. Czechia is going into elections this October and Andrej Babis’ ANO looks poised to form a new government. The negative perception of China among ANO voters does not imply that the new government would have the political capital to return to the honeymoon era of relations a decade ago. This does not preclude, however, a more “pragmatic” approach to China, which ANO has been talking about in the opposition.

Hungary will hold elections next year, and Orban’s power seems to be, for the first time, in real jeopardy. Tisza has been outperforming Fidesz in the polls, threatening Orban’s hold on power. If there is indeed a change in the government, Budapest’s alignment with China may be under threat. Fidesz’s association with China, and the related issues that have sparked local controversy, might be partly to blame.

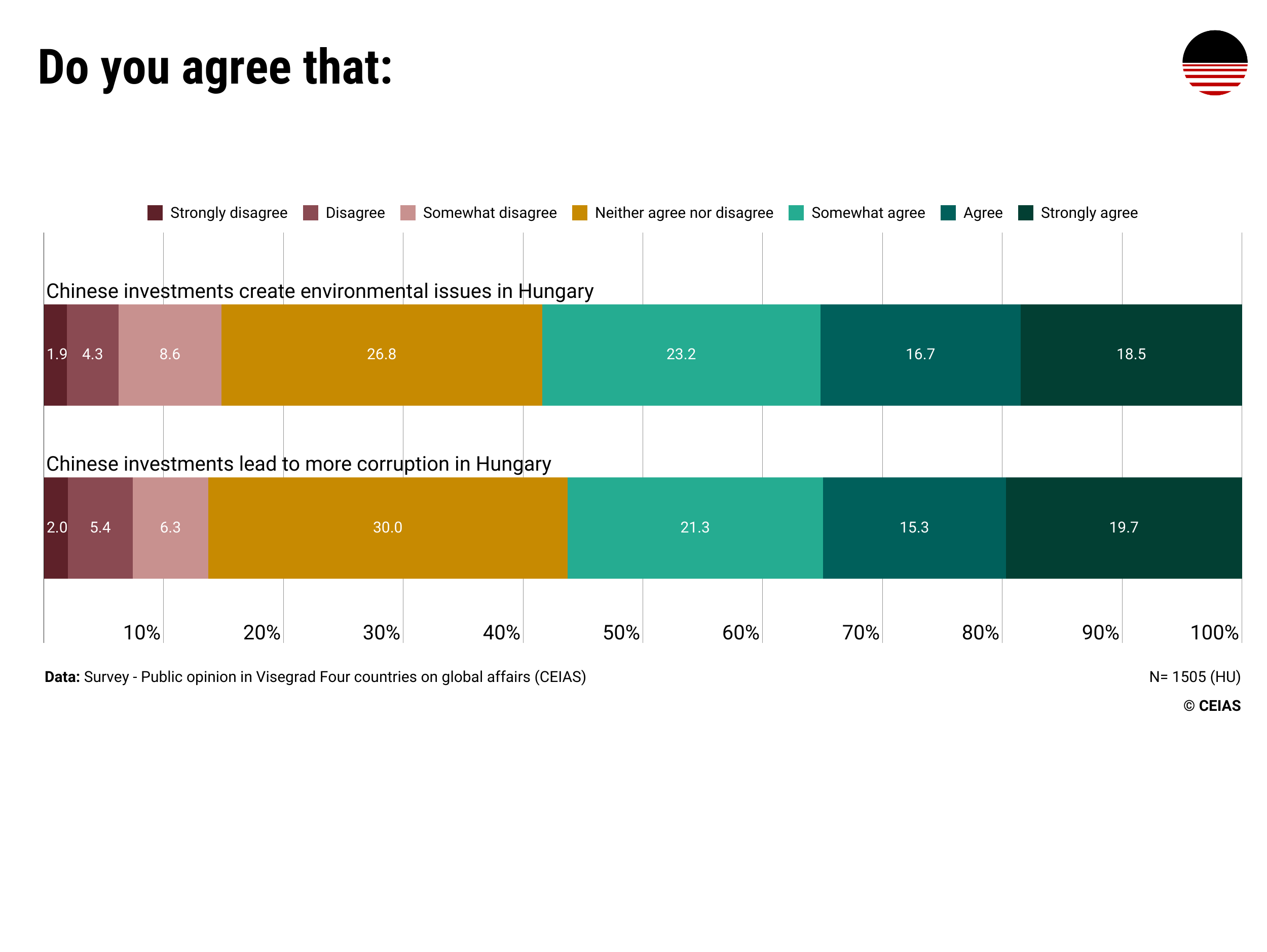

The polling shows that Hungarians have the most negative perceptions of Chinese investments in the V4, despite, or perhaps because Hungary hosts the largest amount of Chinese capital in the region. Moreover, 58.4 percent of Hungarians agree that Chinese investment brings environmental problems to the country, while 56.3 percent see Chinese investment as increasing corruption in Hungary.

The polling thus shows the need to look beyond official policies to understand the dynamics of relations with China and anticipate potential recalibrations on the horizon.